Latest Version

Version

1.1.96

1.1.96

Update

July 09, 2025

July 09, 2025

Developer

IndusInd Bank Ltd.

IndusInd Bank Ltd.

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.indusind.indie

com.indusind.indie

Report

Report a Problem

Report a Problem

More About IndusInd Bank: Savings A/C, FD

A faster, smarter banking experience awaits! Try the new IndusInd Bank Mobile Banking App - INDIE.

Open an IndusInd Bank savings account with a 100% digital process and access premium features like scan-and-pay, bill payments, zero-fee transactions and more. Enjoy a zero balance savings account with no non-maintenance charges. From booking a fixed deposit (FD) to applying for an instant loan or credit card, or even investing in mutual funds—do it all from one app.

Savings Account

Open a savings account instantly with ZERO paperwork using the mobile app. Choose an account that suits your needs, including a zero balance account. Your bank account comes with exclusive features:

• Best-in-class interest rates of up to 5% p.a.

• Zero Fee Banking with free NEFT/RTGS transactions

• Free unlimited ATM cash withdrawals on IndusInd Bank ATMs

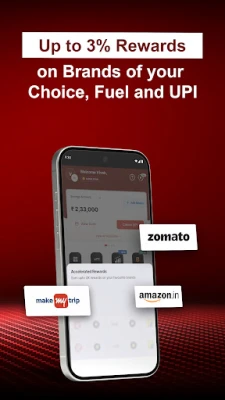

• Up to 3% rewards on the brands of your choice, UPI and fuel

• 0 Forex Mark-up, Complimentary Airport Lounge access

Fixed Deposit

Book a fixed deposit (FD) from the comfort of your home using the mobile banking app. With IndusInd Bank Fixed Deposit, you can:

• Enjoy fixed deposit interest rates of up to 7% p.a.

• Choose your preferred FD option: Regular FD, Tax-saving FD, or senior citizen FD

• Leverage the auto-sweep feature for dual benefit of liquidity & high-returns.

Pay zero charges on pre-mature withdrawals on Auto-Sweep FD. Link your fixed deposit to savings account to pay directly from your FD

Manage your Fixed Deposits on the go with features like: Maturity instructions (auto-renewal, payout, partial renewal), Premature and partial withdrawals, etc.

Instant Personal Loan & Line of Credit

Facing a cash crunch? Get an instant personal loan with 100% digital application process.

• Get up to ₹5 lakh instantly in your bank account

• Save more with discounted Processing Fee

• Choose from a range of flexible tenure options

• Enjoy low interest rates

You can also avail instant line of credit within the IndusInd Bank Mobile Banking app and enjoy speedy disbursals with just a few taps.

• Withdraw money anytime, multiple times

• Pay interest only on the withdrawn amount

• Pick from a range of flexible tenure options ranging from 1 to 36 months

Credit Card Application & Management

Apply instantly for an IndusInd Bank Credit Card with 100% paperless process and instant approval—manage it all via the Mobile Banking App.

• Set/Reset credit card pin and transaction limits

• Access instant statements and track spends in real time

• Pay bills securely and conveniently from the app

• Keep a track of your reward points

Recharge & Bill Payment Services

Manage and pay all your utility bills, including electricity, gas, and water, directly through the app. The app also allows you to:

• Securely top-up your mobile, DTH, and data card anytime, anywhere. Automate bill payments to avoid late fees.

• Get real-time payment confirmations and receipts to keep your financial records organised.

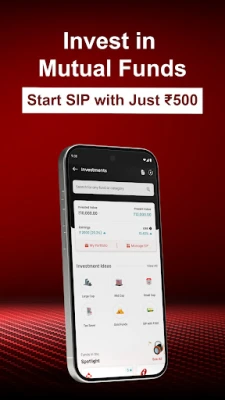

Mutual Funds

Diversify your investment portfolio with a range of mutual fund options available in the app. Whether you're a seasoned investor or just starting out, you can find funds that match your financial goals.

• Start your SIP investment from as low as ₹500 or opt for a one-time lump sum investment

• Buy, sell and manage all your funds in just a few clicks

• Get personalised fund options that match your risk appetite

• Choose from 500+ Large Cap, Mid Cap & Small Cap Equity Funds, Tax-Saving options & more

Safe and Quick Online Fund Transfers

Make payments via UPI, IMPS, NEFT, RTGS and other methods quickly and safely from the mobile app.

• Transfer funds instantly without adding beneficiary

• Add, delete, and manage beneficiaries hassle-free

• Automate recurring payments such as rents, subscriptions, etc.

Get in touch with us

For queries or assistance, reach out to our customer support team

• Email: [email protected]

• Phone: 1860 267 2626

• Timings: 8 am to 8 pm - All Days

Savings Account

Open a savings account instantly with ZERO paperwork using the mobile app. Choose an account that suits your needs, including a zero balance account. Your bank account comes with exclusive features:

• Best-in-class interest rates of up to 5% p.a.

• Zero Fee Banking with free NEFT/RTGS transactions

• Free unlimited ATM cash withdrawals on IndusInd Bank ATMs

• Up to 3% rewards on the brands of your choice, UPI and fuel

• 0 Forex Mark-up, Complimentary Airport Lounge access

Fixed Deposit

Book a fixed deposit (FD) from the comfort of your home using the mobile banking app. With IndusInd Bank Fixed Deposit, you can:

• Enjoy fixed deposit interest rates of up to 7% p.a.

• Choose your preferred FD option: Regular FD, Tax-saving FD, or senior citizen FD

• Leverage the auto-sweep feature for dual benefit of liquidity & high-returns.

Pay zero charges on pre-mature withdrawals on Auto-Sweep FD. Link your fixed deposit to savings account to pay directly from your FD

Manage your Fixed Deposits on the go with features like: Maturity instructions (auto-renewal, payout, partial renewal), Premature and partial withdrawals, etc.

Instant Personal Loan & Line of Credit

Facing a cash crunch? Get an instant personal loan with 100% digital application process.

• Get up to ₹5 lakh instantly in your bank account

• Save more with discounted Processing Fee

• Choose from a range of flexible tenure options

• Enjoy low interest rates

You can also avail instant line of credit within the IndusInd Bank Mobile Banking app and enjoy speedy disbursals with just a few taps.

• Withdraw money anytime, multiple times

• Pay interest only on the withdrawn amount

• Pick from a range of flexible tenure options ranging from 1 to 36 months

Credit Card Application & Management

Apply instantly for an IndusInd Bank Credit Card with 100% paperless process and instant approval—manage it all via the Mobile Banking App.

• Set/Reset credit card pin and transaction limits

• Access instant statements and track spends in real time

• Pay bills securely and conveniently from the app

• Keep a track of your reward points

Recharge & Bill Payment Services

Manage and pay all your utility bills, including electricity, gas, and water, directly through the app. The app also allows you to:

• Securely top-up your mobile, DTH, and data card anytime, anywhere. Automate bill payments to avoid late fees.

• Get real-time payment confirmations and receipts to keep your financial records organised.

Mutual Funds

Diversify your investment portfolio with a range of mutual fund options available in the app. Whether you're a seasoned investor or just starting out, you can find funds that match your financial goals.

• Start your SIP investment from as low as ₹500 or opt for a one-time lump sum investment

• Buy, sell and manage all your funds in just a few clicks

• Get personalised fund options that match your risk appetite

• Choose from 500+ Large Cap, Mid Cap & Small Cap Equity Funds, Tax-Saving options & more

Safe and Quick Online Fund Transfers

Make payments via UPI, IMPS, NEFT, RTGS and other methods quickly and safely from the mobile app.

• Transfer funds instantly without adding beneficiary

• Add, delete, and manage beneficiaries hassle-free

• Automate recurring payments such as rents, subscriptions, etc.

Get in touch with us

For queries or assistance, reach out to our customer support team

• Email: [email protected]

• Phone: 1860 267 2626

• Timings: 8 am to 8 pm - All Days

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

DMV Practice Test Permit GenieElegant E-Learning

Improve Flexibility in 30 DaysSteveloper

River Crossing YMCAEGYM

Duddu - My Virtual Pet DogBubadu

2025 California Driver's TestAvance Digital

Old Friends Dog GameRunaway Play

Hundeo - Puppy & Dog TrainingHundeo

Time Timer Visual ProductivityTime Timer LLC

Insight Timer - Meditation AppInsight Network Inc

Reform Alliance (RSRA)Roofing & Solar Reform Alliance